Did you enjoy today’s car news? Please share your thoughts, comments or questions regarding this topic by submitting a letter to the editor here, or contact us at [email protected].

Inside the car: The Simple Truths About Leadership and How to Practice Them with Ken Blanchard and Randy ConleyThroughout the hustle and bustle of leading an organization, the fundamentals of leadership can often be pushed into the background or, in some cases, completely forgotten. Today’s guests say it’s totally okay to go back to basics. […]]]>

Inside the car: The Simple Truths About Leadership and How to Practice Them with Ken Blanchard and Randy ConleyThroughout the hustle and bustle of leading an organization, the fundamentals of leadership can often be pushed into the background or, in some cases, completely forgotten. Today’s guests say it’s totally okay to go back to basics. […]]]>

Inside the car:

The Simple Truths About Leadership and How to Practice Them with Ken Blanchard and Randy Conley

Throughout the hustle and bustle of leading an organization, the fundamentals of leadership can often be pushed into the background or, in some cases, completely forgotten. Today’s guests say it’s totally okay to go back to basics. Today on Inside Automotive, we are pleased to welcome the co-authors of “The Simple Truths of Leadership: 52 Ways to Be a Servant Leader and Build Trust», Ken Blanchard and Randy Conley. Watch the full segment here.

Securities:

car manufacturers are express extreme dissatisfaction with dealers charging customers far more than manufacturers’ suggested retail prices. According to Edmunds, more than 80% of car buyers in the United States paid a price above MSRP last month, which is exceptionally higher at around 3% in January 2021. So far, Ford and General Motors have expressed the most public opposition, with each automaker issuing warnings to dealers about the practices and threatening to reallocate new inventory to other dealerships. Despite the ongoing controversy, automakers remain committed to finding ways to work with dealerships to facilitate sales of new electric and hybrid vehicles as well as manage the shift to the direct-to-consumer model.

General Motors said Monday that it would be increase your climate equity fund to $50 million, double its initial investment. GM executive Kristen Siemen said the increased investment will increase inclusion and involve the community more in efforts to eliminate emissions. The automaker is also continuing to support various nonprofits to further facilitate its goals of creating “clean energy jobs,” “sustainable transportation,” and “community climate action.” GM also has a separate $35 billion fund earmarked for research and development of electric vehicles and charging solutions.

According to a recent Securities and Exchange Commission filing, Tesla CEO Elon Musk donated over five million Tesla shares to charity in November. Although the name of the charity was not disclosed, it was worth more than $5.7 billion and the shares were donated at the same time as Musk said he would sell for more than $16 billion. shares after Twitter users said so. Musk has continually come under scrutiny when it comes to his taxes, and analysts say the recent donation could give him tax advantages, as donations are potentially subject to lower taxes. The recent donation is not his first, as he has continuously donated billions of dollars in grants to various causes.

According to a filing with the Securities and Exchange Commission, Sonic Automotive made some changes to its board of directors and increased compensation for four executives, and setting new standards for their bonuses. At the 2022 annual meeting of shareholders, Victor Dolan and Robert Heller announced they would not be seeking re-election, while Speedway Motorsports executive Michael Hodge was named a new member of the board. The SEC filing also indicates that its executive chairman, CEO, chief financial officer and chairman will receive 20% salary increases and that their bonuses going forward will depend on adjusted earnings per share and overall customer satisfaction. . Sonic Automotive is set to release its results today.

Celebrating Black History Month:

This February, in honor of Black History Month, we want to celebrate and recognize the past, present and future accomplishments of Black automotive retail professionals. Today we would like to highlight Edward Welburn, former vice president of global design for GM.

This February, in honor of Black History Month, we want to celebrate and recognize the past, present and future accomplishments of Black automotive retail professionals. Today we would like to highlight Edward Welburn, former vice president of global design for GM.

After being amazed by a Cadillac he saw at the Philadelphia Auto Show when he was 11, Welburn wrote to General Motors asking him to become a car designer. Later, General Motors gave Welburn an internship and he spent 44 years with the automaker, including 13 as GM’s vice president of global design. Welburn oversaw the development of iconic cars like the Corvette, Camaro and Escalade.

News and Notices:

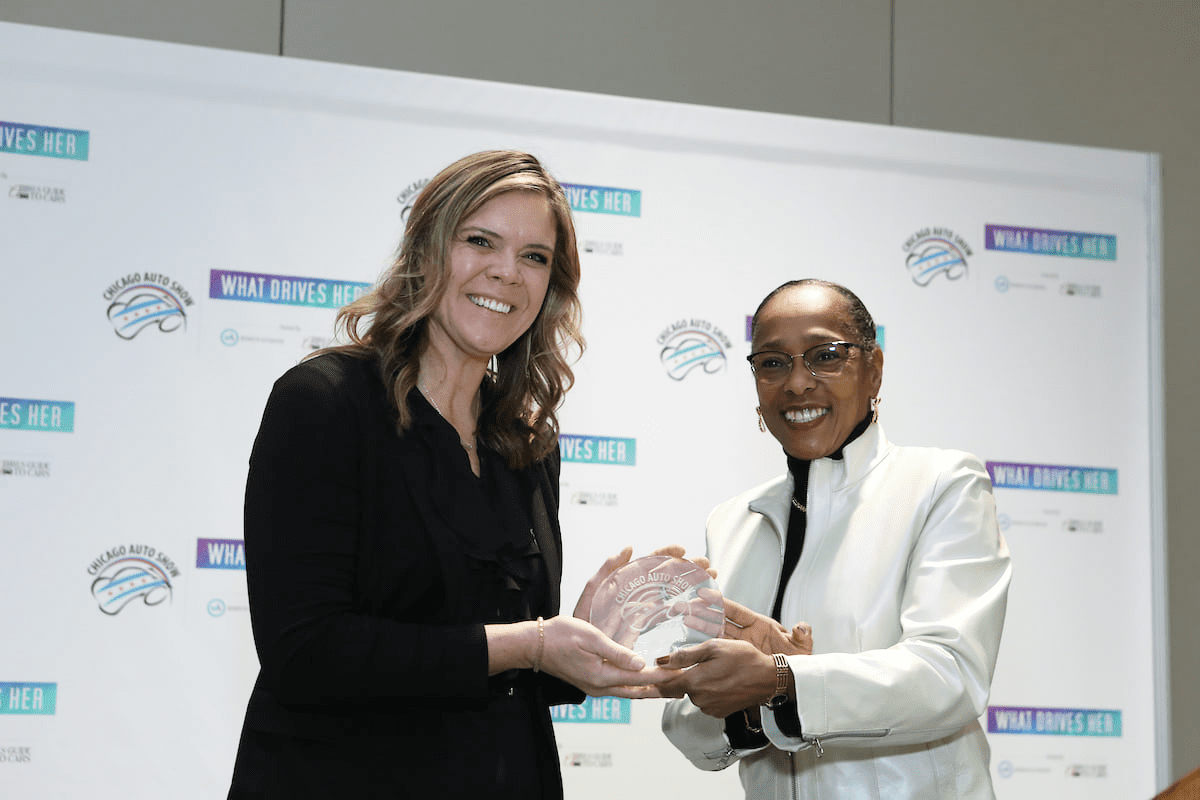

Automotive professionals rewarded at the What Drives Her Awards

The fifth annual What Drives Her program took place on February 11 as part of the Chicago Auto Show media preview. Every year, female powerhouses in the automotive industry come together to recognize top successes and share tips and personal stories. This includes women retailers, suppliers, manufacturers and media moguls across the United States who continue to succeed in the automotive industry. The What Drives Her program is just one of many resources for women in the industry, which includes all women, from auto buyers to automotive executives. Read more

As border blockade ends, automakers have some catching up to do

The Ambassador Bridge runs again between the United States and Canada after a the week-long blockade has been lifted by Windsor Police. However, the days when the corridor has been obstructed by protesters has created another economic hurdle that the auto industry will have to overcome. Auto industry shutdowns and idle lines are estimated to cost about $300 million in losses, according to Anderson Economic Group which analyzed the effects. Of the losses, nearly $150 million relate to lost wages alone, suffered by assembly plant workers when their shifts were cancelled. Michigan autoworkers were the hardest hit, accounting for more than a third (estimated at $51.26 million) of lost wages. Rread mohD

TeslaTSLA, +3.61% won’t unveil any new models in 2022. The electric automaker isn’t struggling. The announcement follows its most successful quarter and most successful year. But with the entire auto industry hampered by a global shortage of microchips, Tesla will spend the rest of this year focused on keeping production of its current products as […]]]>

TeslaTSLA, +3.61% won’t unveil any new models in 2022. The electric automaker isn’t struggling. The announcement follows its most successful quarter and most successful year. But with the entire auto industry hampered by a global shortage of microchips, Tesla will spend the rest of this year focused on keeping production of its current products as […]]]>

TeslaTSLA,

won’t unveil any new models in 2022. The electric automaker isn’t struggling. The announcement follows its most successful quarter and most successful year. But with the entire auto industry hampered by a global shortage of microchips, Tesla will spend the rest of this year focused on keeping production of its current products as high as possible.

A flurry of Tesla news

Most automakers operate a public relations department that maintains a steady cadence of press releases about future products and answers questions from reporters. Tesla does not.

That leaves reporters to gather all possible information from CEO Elon Musk’s Twitter account and quarterly shareholder communications.

The company’s fourth quarter results led to a sudden flurry of news from Tesla.

Model 3, Y keeps everyone busy

New car sales are down, but electric car sales are soaring. Overall new car sales fell by more than 21% between the last quarter of 2020 and 2021. But electric car sales increased by almost 72%.

Tesla Controls US Electric Car Market More than 72% of all electric cars sold in the US last quarter were Tesla products. The Model Y SUV was the top-selling electric vehicle (EV) in the United States last quarter, with more than 63,000 units sold. The Tesla Model 3 sedan came in second, with more than 41,000 sold.

Other automakers have started introducing electric cars, bringing Tesla a fight it has never faced before. But the competition is still small in Tesla’s rearview mirror. The Ford F,

The Mustang Mach-E came a long way behind, with just over 8,000 sales.

With such high demand for the Model Y and Model 3, Musk says, almost every microchip the company can get its hands on is going into building one or the other. “If we were to introduce new vehicles, our total vehicle production would decrease.”

No Cybertruck, Roadster, Model 2

With that in mind, the company has officially delayed the next product it was to bring to market – its cyberpunk-looking electric pickup truck, the Cybertruck. The impending delay of the truck seems inevitable since Tesla removed all dates from its reservation site for the truck last month. But Musk made it official during an investor call on Jan. 26.

It also delayed a plan to resurrect the company’s first product – the Tesla Roadster – and a plan to develop an electric tractor-trailer. Bringing out new products now, Musk said, “wouldn’t make sense because we’ll still be limited in parts.”

As for a rumored attempt to build a sub-$25,000 car — Tesla fans informally call it the Model 2, though the company hasn’t officially named it — Musk says it doesn’t. is not even at the planning stage.

“We’re not currently working on a $25,000 car,” Musk said on the call. “We have too much on our plate.”

See: Where is Tesla’s Cybertruck?

Certain risks of delay

Delaying products whose parts you can’t get to build seems like an obvious step. But there is some risk for Tesla in letting future products slip further into the future.

Musk showed off a prototype of the Cybertruck in 2019, when it appeared to be the first electric pickup on the market.

The best Tesla can do now is fourth. The rival of the startup Rivian RIVN,

has already started deliveries of its well-reviewed R1T electric truck. The first GMC Hummer EV pickups also reached customers. Ford has accepted more than 200,000 reservations for its F-150 Lightning and expects to begin deliveries this year. Lighting is an all-electric version of America’s best-selling vehicle, the Ford F-150 pickup.

Also see: Here’s Ford’s F150 Lightning in numbers

If Tesla waits longer on the Cybertruck, it could fall behind Chevrolet’s recently revealed Silverado EV.

The Roadster, as a performance 2-seater, has no current equivalent.

If Tesla were to build an electric car under $25,000, they would likely have that segment of the market to themselves. Currently, it is possible to buy a Nissan Leaf for less than $20,000 once the federal tax incentives are applied. But Nissan NSANY,

intends to replace the Leaf with an SUV that will likely cost more.

Chevrolet has announced plans to build an electric version of its Equinox SUV with a target price of “about $30,000”. Several EVs currently on the market carry price tags in the low $30,000 territory after federal tax refunds, but their sticker prices remain in the $40,000 range.

This story originally took place on KBB.com.

As we look to the future this year, automotive designers and OEMs will be looking at different ways to speed up the development and manufacturing process to shorten the overall release cycle so that more time can be spent on design of highly personalized solutions. Here are five predictions of what’s to come for the […]]]>

As we look to the future this year, automotive designers and OEMs will be looking at different ways to speed up the development and manufacturing process to shorten the overall release cycle so that more time can be spent on design of highly personalized solutions. Here are five predictions of what’s to come for the […]]]>

As we look to the future this year, automotive designers and OEMs will be looking at different ways to speed up the development and manufacturing process to shorten the overall release cycle so that more time can be spent on design of highly personalized solutions.

Here are five predictions of what’s to come for the auto industry in 2022:

More edge computing power

As we advance in the capabilities of autonomous vehicles, more computing power is needed at the edge. This computing power is needed to support the wide range and volume of sensors and devices needed to perform specific aspects of autonomous driving and adapt to driver conveniences.

By delivering computing power to the edge, overall processing is accelerated and overall data throughput on the vehicle network is reduced.

However, even more computing power will move to the central core of the vehicle as the next generation of consolidated computing platforms become more widespread. The next generation, which will likely be introduced at the end of this year, will consolidate ancillary services and system-on-chips (SoCs) that are typically spread throughout the vehicle.

Within this central compute core, we’re going to see fewer and more powerful SoCs each containing multiple compute cores as well as specialized cores for virtualization. The virtualization function within the SoC will provide services to the vehicle that would normally have been offered through a dedicated microcontroller or dedicated electronic control unit (ECU).

Automotive cybersecurity will become more integrated into automotive organizations

This year, car manufacturers will ask many important questions regarding the implementation of car safety standards, in particular ISO/SAE 21434which includes security management, project-dependent cybersecurity management, ongoing cybersecurity activities, associated risk assessment methods, and cybersecurity in the development and post-development phases of road vehicles.

In 2022, organizations must prioritize cybersecurity and integrate these activities into their established programs.

Digital twins will become more prevalent in automotive design and testing

The need for digital twin technologies in the automotive industry will only increase in 2022 as custom processors and more software are managed and delivered through the automotive software pipeline. System architects have to answer many questions about brand-new ECUs, such as: how do they work, what is the packaging, and when can software start testing on them? The hardware required to start software testing can take months or even years to be ready. When a digital twin is available, this time is reduced considerably. As designers develop the next iteration of hardware design, they can model it in a digital version and quickly make it available to software developers.

The era of electric vehicles begins in earnest

It is very likely that 2022 will be the tipping point where we start to see batteries-electric vehicles (EVB) become mainstream.

OEMs will showcase models that cover a wide range of needs, from entry-level BEVs to high-end BEVs that have full cruising capabilities, extended range, traditional driving aids, smart capabilities around autonomous drivinghighway driving assistancehigh automation of driving, etc.

Manufacturers are beginning to determine what consumers really want in their vehicles while solving technical challenges, such as material availability and manufacturing cost.

People may start moving away from personal vehicles

Will group or fleet owned vehicles become more of the norm over individually owned vehicles, especially in high density metropolitan areas? Consumers who purchase this model have access to a vehicle they can program or call on demand and receive in 30 minutes or less.

We have already seen many organizations and startups offering this type of solution, but there is a lot of room to grow and understand what consumers are looking for in this market segment. The outcome will depend on many factors, including how consumers perceive the potential transmissibility of COVID-19 (or another pathogen) in a shared vehicle over the next 12 months.

Ultimately, automakers will bring innovation and creative problem solving to the table in 2022 to meet the challenges caused by supply chain disruption, the economic effects of COVID-19, changing consumer preferences, new cybersecurity standards and the need to develop sustainable options.

Chris Clark (photo, left) is senior manager – Automotive Software & Security for the Synopsys Automotive Group, who helps develop secure OTA software updates and in-vehicle applications.

- Sales of ultra-luxury cars boomed in 2021 as the auto industry struggled to build enough cars.

- Rolls-Royce, for example, increased sales by 49% in 2021.

- Super premium brands saw strong demand and were unaffected by the chip crisis.

Automakers sold millions of vehicles less than usual in 2021 as a shortage of computer chips and other pandemic-related disruptions threw wrench after wrench into the cogs of auto manufacturing.

But ultra-premium brands like Bentley and Rolls-Royce have thrived amid the chaos. A booming stock market has made wealthy consumers even wealthier, while the pandemic has caused them to open their wallets for physical goods instead of travel and vacations. Moreover, super premium brands have not been affected by the shortage of semiconductors like mass manufacturers.

Rolls-Royce, whose flagship Phantom starts at around $460,000, sold a record 5,586 cars in 2021, up 49% from 2020. Bentley moved 14,659 vehicles, a 31% increase from compared to the previous year. Lamborghini also had a banner year.

Bentley Flying Spur W12.

Bentley

In part, sales have exploded for the simple reason that the wealthy have gotten richer over the past two years. Luxury vehicle sales are directly correlated with the stock market, said Michelle Krebs, executive analyst at Cox Automotive.

A strong market during the pandemic – a market that has doubled the wealth of the 10 richest people in two years – may have prompted a certain segment of buyers to pull the trigger on this 400,000 Rolls-Royce Cullinan SUV $200,000 bespoke or $200,000 Bentley Continental they coveted.

People had more free time and fewer opportunities to splurge while traveling and dining out, so they directed their spending towards exclusive and special products they could enjoy from home, said Rolls CEO Martin Fritsches -Royce Motor Cars Americas, to Insider.

Rolls-Royce and Bentley also attribute booming demand in recent years to new product offerings that have attracted early buyers. Since late 2019, Bentley has launched new models, paint schemes and a dark Blackline accessory package, all of which have appealed to younger customers, said Michael Rocco, vice president of sales and operations for Bentley Americas.

Likewise, Rolls-Royce’s Cullinan – its first SUV and first all-wheel-drive vehicle – was “a major shift,” Fritsches said. Thanks to her and other models, the average age of Rolls-Royce customers fell to 43.

The Rolls-Royce Cullinan SUV.

Rolls Royce.

But demand is only half of the equation. Perhaps the biggest question is how these companies were able to satisfy a growing appetite in an auto manufacturing environment plagued by parts shortages, shipping crises and other disruptions.

Niche manufacturers tend to have smaller, more stable supply chains, which means there’s less chance of running out of parts or materials, said Kevin Tynan, senior automotive analyst at Bloomberg intelligence. Rolls-Royce, for example, builds all its vehicles in a single factory in England. A giant like Toyota manufactures millions of cars in factories all over the world.

Another piece of the puzzle is that Bentley and Rolls-Royce are owned by large parent companies – the Volkswagen Group and the BMW Group, respectively – which have strong incentives to allocate as many computer chips as necessary to their most profitable products and brands. Neither Rolls-Royce nor Bentley had any problems getting the chips they needed, the companies told Insider. Prioritizing high-margin vehicles when inventory is running low is “case 101,” Tynan said.

With the surge in super-premium sales comes a broader boom in the luxury vehicle space. In 2021, Porsche and BMW saw huge growth while mainstream brands struggled. In 2012, only 6% of cars purchased in the United States cost $50,000 or more, according to Cox Automotive. In 2021, this figure has increased to 30%.

Two merchants were named members of the Order of Canada. Vaughn Wyant and Ralph Chiodo were among 135 appointments announced Dec. 29 by Governor General Mary Simon. Wyant was selected “for his contributions as a business leader in Western Canada’s automotive industry and for his community philanthropy,” Gov-Gen. Mary Simon said in a statement. Wyant […]]]>

Two merchants were named members of the Order of Canada. Vaughn Wyant and Ralph Chiodo were among 135 appointments announced Dec. 29 by Governor General Mary Simon. Wyant was selected “for his contributions as a business leader in Western Canada’s automotive industry and for his community philanthropy,” Gov-Gen. Mary Simon said in a statement. Wyant […]]]>

Two merchants were named members of the Order of Canada.

Vaughn Wyant and Ralph Chiodo were among 135 appointments announced Dec. 29 by Governor General Mary Simon.

Wyant was selected “for his contributions as a business leader in Western Canada’s automotive industry and for his community philanthropy,” Gov-Gen. Mary Simon said in a statement.

Wyant said the announcement of his joining came as a surprise.

“I’m honestly quite blown away.”

Wyant, 69, joins his late father, Dr Gordon Wyant, who was admitted to the Order in 1991, and says his father is typical of what he considers Order of Canada material – a medical pioneer, a German national who fought for Britain in World War II and an academic and educator.

Wyant leads the Wyant Group, which owns 20 dealerships in Alberta, Saskatchewan and British Columbia, as well as a finance company, oil change shop and retailer, and is majority shareholder of Great Western Brewing Co. . from Saskatoon.

His philanthropy includes donations of $1 million to the Remai Modern Art Gallery in Saskatoon and $500,000 to the University of Saskatchewan. He currently leads fundraising efforts for the STARS Air Ambulance in Saskatoon. Over $3 million has been raised to date.

Chiodo, CEO of auto repair chain Active Green + Ross and president of Peel Chrysler FIAT, was cited for “his community involvement and generous philanthropy, and for his leadership in the automotive industry.”

Italian-born Chiodo broke into the auto industry in 1966 when he bought a BP gas station in Toronto. He branched out into service sector franchising and renamed the operation Active Tire and Auto Centre. In 1993, he bought the service chain Green + Ross in 1993. In 1995, Active Green + Ross was born.

Chiodo now leaves the operation of the two companies to its managers, Peter Steele at Active Green + Ross and his son-in-law, Danny Diamantakos, who is a master dealer at Peel Chrysler FIAT.

Chiodo’s philanthropy includes assisting with several hospital fundraisers, including an annual fundraiser for the Trillium Health Center that raised over $500,000. He is also one of 26 Italian families who sponsor the Art Gallery of Ontario’s Galleria Italia and regularly sponsors local events, such as the Toronto Ribfest Canada Day Weekend hosted by the Rotary Club of Etobicoke.

Detroit News DETROIT – With automakers only expecting to sell about as many vehicles in 2021 as in the last years of the Great Recession and with supply issues still hampering production, the U.S. auto industry is unlikely to see of recent sales before the pandemic in the near future. Forecasters predict 2021 will end […]]]>

Detroit News DETROIT – With automakers only expecting to sell about as many vehicles in 2021 as in the last years of the Great Recession and with supply issues still hampering production, the U.S. auto industry is unlikely to see of recent sales before the pandemic in the near future. Forecasters predict 2021 will end […]]]>

Detroit News

DETROIT – With automakers only expecting to sell about as many vehicles in 2021 as in the last years of the Great Recession and with supply issues still hampering production, the U.S. auto industry is unlikely to see of recent sales before the pandemic in the near future.

Forecasters predict 2021 will end with around 15 million vehicle sales or slightly less when automakers release figures for the year and the fourth quarter next week. That would be an increase from 14.7 million in 2020, but well below the tally of over 17 million in 2019 and even below the nearly 15.4 million in 2012.

The culprit: a global shortage of microchips that crippled production even as demand pushed average transaction prices to record highs.

General Motors Co. and Stellantis NV to publish sales on Tuesday; Ford Motor Co. will share its figures on Wednesday.

Customers like Silas Williams of Macomb Township, Mich., Have postponed securing new leases into 2021 as they saw prices rise and supply decrease on dealer lots. Instead of renting a new Dodge Durango SUV like Williams and his wife, Leenet Campbell-Williams, do every few years, the couple opted to buy their lease instead, which cut their payment in half. They now have a 2018 Durango which is worth more than Silas expected.

“We plan to keep the vehicle, and maybe, I don’t know, my wife could later in 2022, she could look to get another vehicle,” he said. “We’ll see what the landscape is. “

Analysts expect sales to increase slightly in 2022: estimates range from 15.2 million to 15.8 million. These include the expectation that automakers have earned their place to secure the necessary semiconductors that power on-board electronics like automated driving functions, infotainment systems and heated seats, and that the pandemic of COVID-19 does not lead to more production or demand. disturbances.

Edmunds.com Inc.’s projection is rather weak with 15.2 million in sales.

“Every part in inventory is going to be sold or has already been sold,” said Ivan Drury, senior director of information at the Vehicle Information website. “It really comes down to: what do we think automakers can produce? “

The chip shortage alone is expected to cost the production of 7.7 million vehicles worldwide and $ 210 billion in lost revenue in 2021, according to the latest forecast from global consulting firm AlixPartners LLP.

But Dan Hearsch, general manager of the automotive and manufacturing practice of AlixPartners, said the chip shortage situation is improving overall.

“The problems that keep hitting us are really less with the chips, I mean, certainly, the chips here and there, but it’s the labor, it’s the steel, it’s the pieces glued on. a boat in California, ”he said.

Automakers say visibility into the microchip shortage deep in their supply chains isn’t great, even nearly a year after they started running out of parts.

They expect the problems to persist through 2022, although they had fewer fourth-quarter plant closures in North America. Stellantis cites weak demand for production stoppages at some of its factories in January, not chips.

Some estimates place annual vehicle demand at 17 million or even 18 million, says Michelle Krebs, executive analyst at Cox Automotive. That’s because Americans have more in their wallets due to the federal COVID-19 stimulus, reluctance to use public transit and carpooling, and increasing household savings as the pandemic continues. limited leisure activities.

This demand, however, comes as automakers and their retailers reap the benefits of low supply, vehicle orders, and customers willing to pay above the manufacturer’s suggested retail price. In November, the average MSRP was $ 662 lower than the average transaction price of $ 45,872, which was up 15% year-over-year.

AutoForecast Solutions LLC does not forecast auto sales to exceed 17 million by 2028, said Sam Fiorani, vice president of global forecasting. It highlights the slow transition from internal combustion engine vehicles to electric vehicles, which accounted for 3% of US sales in 2021; Edmunds predicts that the electric vehicle market share could reach 4% next year.

“People who love their ICE vehicles will find the replacement expensive, as emission regulations and electric vehicle competition drive up the price,” Fiorani said. “There will be fewer buyers for these, and in turn, fewer buyers compared to the current level of electric vehicles. We will see more and more older internal combustion engines as the age of vehicles continues to increase.

This prediction, he noted, is, however, based on the industry’s new sales direction which emphasizes customer orders and reducing dealer inventory: “If dealers and manufacturers get together. arguing for volume again, we can see that number increase dramatically. “

For now, supply is improving from record lows. The inventory of new vehicles stood at nearly one million vehicles at the end of November, the highest level since the beginning of August but still down 64% from 2020, according to Cox Automotive. The inventory of unsold new vehicles reached 1 million as of Dec. 6, Krebs said.

“We think things are going to get better, but stocks are always going to be low because we have a pipeline that needs to be filled, and it’s very low right now,” she said.

“It’s kind of a stabilization; it doesn’t get worse.

Sales started strong in 2021, but as the chip shortage compounded production losses, there were simply no vehicles left for sale. “It’s the worst six months we’ve seen in a decade in terms of falling sales, not demand, but sales,” Krebs said.

Prior to Christmas Eve, dealer Jeff Laethem only had seven field vehicles for sale at his Ray Laethem Buick GMC dealership on Mack Avenue in Detroit. Before the pandemic, it would have had more than 400. The Chrysler Dodge Jeep Ram dealer in Laethem in the street is doing a little better, with 130 vehicles on the ground. Before, he would have had 500-600.

“Something has to give,” Laethem said.

“It is becoming more and more difficult to do operationally. There was a time when we were selling enough vehicles before it got really low like now, where we could be quite profitable even selling fewer cars because we didn’t have any of the expenses to keep the cars on the ground. , but now that we’re coming back to next to nothing, there’s not much profit to make up for it.

December, typically one of the busiest selling months of the year, was hit due to the shortage. New vehicle sales for December are estimated at 1.2 million, down 21% from December 2020, according to a joint forecast from JD Power and LMC Automotive. Fourth-quarter JD Power and LMC project sales to reach 3.3 million, down 20% year-on-year, even as full-year sales are expected to increase 4% .

“While the inventory situation has improved slightly since November, supply remains well below the level at which consumer demand for new vehicles can be met,” said Thomas King, president of the data and analytics division. at JD Power, in a press release. “The intense demand with this limited supply leads to a continuous increase in prices. “

Bess Wills, part owner and general manager of Gresham Ford in eastern Oregon, points out the positives for customers: They can order exactly what they want from a vehicle and the dealership will honor the incentives in effect at the order date or delivery date, giving buyers whatever the lowest price.

“Trucks are coming in every day and two-thirds are orders already sold,” said Wills, noting that she is lucky to have 25 cars on her lot compared to the more typical 120-150. “Over 50% of our retail sales this month are orders. I know we will continue to try to do this. So as long as we can keep people interested and have a chance to wait.

That’s not a problem right now, she said, with products like the new Bronco SUV and the upcoming all-electric Lightning F-150 truck, for which she has 100 reservations.

High prices have not slowed down demand. Dealers say they sell vehicles before they arrive.

As of December 23, Jim Ellis Chevrolet in Atlanta had more than 80 vehicles in transit to the dealership, but those had been on hold for months awaiting parts. In the field, the lot has around 30 vehicles for sale, said managing director Ralph Sorrentino.

Sorrentino doesn’t expect the situation to improve much until maybe summer, and that is if “we don’t have more news on the radar by then”.

“Demand is still record high,” he said. “People want to post bonds, they want yesterday’s cars. Everyone wants a new car. It’s kind of a good place to be in for a little bit.

© 2022 www.detroitnews.com. Visit detroitnews.com. Distributed by Tribune Content Agency, LLC.

[ad_1] The COVID-19 pandemic has transformed almost every aspect of life. From the way you shop at Zoom meetings, the world has adjusted to its “new normal” over the past couple of years – and the auto industry is no different. Fewer drivers visit dealerships, and more search and even buy directly online. If you […]]]>

[ad_1] The COVID-19 pandemic has transformed almost every aspect of life. From the way you shop at Zoom meetings, the world has adjusted to its “new normal” over the past couple of years – and the auto industry is no different. Fewer drivers visit dealerships, and more search and even buy directly online. If you […]]]>

[ad_1]

The COVID-19 pandemic has transformed almost every aspect of life. From the way you shop at Zoom meetings, the world has adjusted to its “new normal” over the past couple of years – and the auto industry is no different.

Fewer drivers visit dealerships, and more search and even buy directly online. If you are planning on purchasing a vehicle in the next year or so, it is wise to understand this new landscape to be better prepared.

Will traditional car dealerships become obsolete?

Simply put, no. The car salesmen and inflatable tubes dancing in front of the dealerships won’t be collecting dust anytime soon. But the days of crowded dealerships are over.

Auto dealers are in a period of major transition as they try to catch up with the decline felt in the wake of the pandemic. Dealers are recovering from both the reduced number of drivers on the road from initial stay-at-home orders and current declines due to inflation and the global shortage of chips.

Buying a vehicle has always been an expensive process, but over the course of 2021 it has become even more expensive. October was the sixth month in a row that drivers saw record prices on new cars. Wholesale prices for used vehicles rose 4.9% at the start of November, according to Cox Automotive.

Rising prices and the shortage of chips have also had a huge impact on how dealerships sell cars in another way. Used cars are currently in high demand. Fewer cars produced and higher prices mean more drivers are looking for used cars, and dealerships must change to meet that need.

Online shopping is in

It’s like you can get anything right at your doorstep with just a few clicks. Apps like Uber Eats and Instacart have changed the way consumers shop every day. Unsurprisingly, the automotive market is finally catching up with this trend.

The experience of buying a typical car hasn’t undergone a major transformation in many years, and consumers have become accustomed to the tedious process of getting a new or used vehicle from a dealership. But as safety regulations still remain inconsistent due to COVID-19, many dealers have had to follow suit with changing technology and embrace the expanding online marketplace.

This shift to online car buying is not a completely new idea. Many local dealers have made online marketplaces available for customers to view inventory before arriving in the field. But the experience of buying cars online has become much more in-depth in recent times.

In early October 2021, Hyundai announced a partnership with Amazon that gives drivers access to a virtual showroom called the Hyundai Evolve. Your vehicle still won’t arrive in an Amazon box – once you find the perfect model and finish, the site will connect you with a local Hyundai dealership.

If a door-to-door experience is more your style, Carvana is another retailer that explores a car buying experience almost entirely online. These are the first two of many online options that will gain traction in the years to come.

Bargaining is (mostly) over

A low stock means that the history of negotiating the perfect price is not an integral part of the buying experience. With fewer cars available for purchase, fewer drivers are negotiating their perfect price because they are just happy to be leaving in a new vehicle.

But that doesn’t mean you should dismiss the idea all together. You can often negotiate dealership extras – such as paint protection, anti-rust and VIN etching – to lower your exterior price.

The shortage of fleas

If you’ve been looking for a car for the past few months, you’re probably familiar with the semiconductor shortage. The cause of this shortage dates back to early 2020, when production and consumer demand for vehicles came to a halt due to COVID-19. These chips aren’t just used for vehicles, so as more people worked from home, the focus shifted from vehicles to more personal and professional technologies.

Unfortunately, waves of the chip shortage will continue to impact dealers and consumers in 2022. Available supply is struggling to meet driver demand. Simply, a lack of vehicle inventory has led to an increase in vehicle prices.

It will take some time for dealerships to catch up with demand, which, as mentioned earlier, has led to an increase in the number of drivers flocking to used car options and simply waiting for conditions to improve. But even if some dealers see their profits increase, many lots remain empty. There are fewer vehicles available for sellers to sell, so the market is competitive.

But there are still ways to come away satisfied, even as the chip shortage continues to impact the vehicles available: take advantage of online car shopping.

4 Ways To Use Online Car Shopping To Your Advantage

Online car buying is still relatively new and requires a bit of learning. While some tips are consistent with traditional car buying, heed these tips when you jump off the showroom floor and go online to buy a car.

1. Research

In person or not, do your research to find the right vehicle is the first step in the car buying process. Consider the factors that matter most to you: vehicle size, fuel mileage, or even style and color. While you may not be able to explore your new vehicle in person, YouTube car tours are a great resource for seeing the specifics of a vehicle.

2. Set a budget

After you have defined the type of vehicle you want, it is important to determine how much you are willing to spend and set a budget. Finding this number takes a little extra work but is much easier to do without a salesperson pressuring you. Enjoy being at home and consider all contributing factors, such as your salary, fuel, insurance, and additional vehicle costs.

3. Check the local inventory

Another benefit of buying your vehicle online is the ability to check local inventory before you go looking in person. This can be done in several ways. Look for specific dealers in your area – find Toyotas sold near me or use websites like Edmunds or TrueCar. It will also help to your negotiations because you will have a better understanding of the price landscape for the car of your dreams.

4. Chat online with sellers

Bargaining can be one of the most intimidating parts of the car buying experience, but when you’re sitting behind a computer screen, it’s a lot easier to haggle for the price you deserve. Most of the online marketplaces you come across will have a chat option, use that as a space to ask the right questions. Focus on firmness and share the information you find while checking local inventory on competing pricing options.

The bottom line

It is clear that the car buying experience has changed for both the dealership and the buyer over the past couple of years due to a combination of factors – global pandemic, chip shortage, fuel chain issues. supply, growing technology. But with or without the looming pandemic as we venture into 2022, it’s important to remember that an industry refresh is underway and bringing increased accessibility and transparency to the driver.

So, while the habit of driving to a parking lot is unlikely to go away altogether, it is still best to be prepared to shop online where you can hope to save both money and money. time.

[ad_2]

Duane Paddock is used to hauling over 800 vehicles to his eponymous Chevrolet dealership near Buffalo, New York. But these days, thanks to the semiconductor shortage, he sells most of the vehicles General Motors Co. sends him as soon as they arrive. Since the dealership has almost no inventory, Paddock sales staff sell cars and […]]]>

Duane Paddock is used to hauling over 800 vehicles to his eponymous Chevrolet dealership near Buffalo, New York. But these days, thanks to the semiconductor shortage, he sells most of the vehicles General Motors Co. sends him as soon as they arrive. Since the dealership has almost no inventory, Paddock sales staff sell cars and […]]]>

Duane Paddock is used to hauling over 800 vehicles to his eponymous Chevrolet dealership near Buffalo, New York. But these days, thanks to the semiconductor shortage, he sells most of the vehicles General Motors Co. sends him as soon as they arrive.

Since the dealership has almost no inventory, Paddock sales staff sell cars and trucks by showing customers a computer screen view of the cars’ appearance and placing orders. Then they wait. It works well enough that he thinks he won’t need to haul a lot of cars when, hopefully, the semiconductor shortage one day ends.

There is only one problem: There are still far more interested buyers than vehicles, which is why auto industry sales fell around 20% in the fourth quarter of 2021 and suffered the worst second half since the Great Recession over a decade. There are.

“This will be my lowest volume year in 20 years. We’ll end up with around 2,500 units when I normally do 3,300 to 4,500, ”Paddock said over the phone. “Everything I have, we sell before they arrive. “

Automakers likely sold a seasonally adjusted annual rate of around 12.5 million new vehicles in December, down 23% from the previous year, according to the average forecast of six market researchers. Most automakers will release their latest quarterly and annual new car sales in the United States on Tuesday.

For the year as a whole, auto sales likely hit 14.9 million vehicles, a 2.5% jump from the days of Covid in 2020, according to Cox Automotive. The 2021 total is a historic low for an industry used to selling around 16 million vehicles per year. The slowdown reflects a global shortage of microchips that has forced automakers to limit production or ship some vehicles without fully functional features.

December is generally a huge month for automakers, who typically use holiday promotions to fuel a year-end push. But not in 2021, Cox analyst Michelle Krebs said.

“It’s not a demand issue. It’s a supply problem, ”she said. “We have at least 1.5 million units of inventory late for 2020 and 2.5 million units late for 2019.”

Industry-wide, automakers had about 18 days of inventory in December, according to TrueCar, an auto pricing website. This is up slightly from the end of the third quarter, when automakers were valued at 16 days. But that’s still less than half of what they had a year earlier.

GM, which had maintained production at the start of the crisis, was particularly affected by the shortage of chips in the second half of the year. Toyota Motor Corp. will likely beat GM in US sales for the year because it was able to maintain higher production, Cox predicted.

TrueCar estimates that GM’s December sales fell 43%, which would be the biggest drop of any automaker. Toyota sales have fallen by about 30% and Ford Motor Co. is expected to report a decline of about 20%, according to TrueCar Projects.

Learn more about the semiconductor shortage:

Why major OEMs are turning to in-house chip production

Relentless global demand for chips turns deadly in Malaysia

Watch: Alleviating the Semiconductor Supply Shortage

What will replace silicon chips in the next generation of electric vehicles?

GM Predicts ‘Substantial Changes’ in Supply Chain As Chip Problems Last

How a Covid Case Disrupted Toyota’s Just-in-Time Supply Chain

GM had a record stock at the start of the fourth quarter due to downtime in the third, company spokesman Jim Cain said. The Detroit automaker’s production showed signs of improvement in the fourth quarter as more chips became available, he said.

To help cope with the shortage of vehicles, dealers say GM allows them to extend leases for customers who can’t find a new car.

Consumers who can find the vehicles they want are obligated to pay. Automakers use the semiconductors they get to build more profitable models and those with the most options, according to car buying research firm Edmunds. All of those premium pickup trucks and sport utility vehicles drove a record average price of $ 45,872 in November, up 15% from a year earlier.

Average December transaction prices for GM and Stellantis NV were estimated at more than $ 50,000 by TrueCar, the highest among consumer automakers.

The automakers said there had been some relief in the chip supply and they were starting to ramp up production. Inventories even rose slightly in late November, reaching 1 million vehicles for the first time since August, Krebs said.

Chip-related constraints did not appear to slow Tesla Inc.’s growth in the last three months of the year. The electric vehicle maker said on Sunday it delivered a record 308,600 vehicles in the quarter, beating analysts’ average estimate of around 263,000.

For the industry as a whole, analysts expect better access to semiconductors and an increase in vehicle production this year. Edmunds predicts 15.5 million vehicles will be sold in 2022 and RBC Capital Markets analyst Joe Spak sees 15.8 million as production increases.

This is good news for buyers and sellers alike, who are eager to see a better selection, especially of cheaper models. GM dealer Paddock said he hasn’t seen the economy Chevy Malibu sedan since early last summer and ends up each month with maybe three new vehicles that aren’t already sold at the advance.

“When are we going to get back to inventory?” I guess it’s two years from today, ”he said. “It’s going to take a long time before you see the inventory on the customer lots. “

[ad_1] Self-driving cars can reshape the future of the auto industry to a large extent In this age of technology, AI has created a visible impact on almost every industry available in this world and the auto industry is no exception. Self-driving cars or self-driving cars are gradually gaining popularity around the world. Several semi-autonomous […]]]>

[ad_1] Self-driving cars can reshape the future of the auto industry to a large extent In this age of technology, AI has created a visible impact on almost every industry available in this world and the auto industry is no exception. Self-driving cars or self-driving cars are gradually gaining popularity around the world. Several semi-autonomous […]]]>

[ad_1]

Self-driving cars can reshape the future of the auto industry to a large extent

In this age of technology, AI has created a visible impact on almost every industry available in this world and the auto industry is no exception. Self-driving cars or self-driving cars are gradually gaining popularity around the world. Several semi-autonomous driving systems such as Lane Assist, Adaptive Cruise Control (ACC), Electronic Stability Control (ESC), Reversing Video Systems (RVS), Adaptive Highlights, Mitigation forward collisions (FCM), automatic emergency braking (AEB), and many more are already on the road. The days are not far off when we will fully witness autonomous cars move on the busy roads of our city.

The whole world admires the automakers and tech companies, who can develop this complex technology, which will allow these driverless cars to drive on their own. The Institute of Electrical and Electronics Engineers (IEEE) has predicted that by the end of 2040, these self-driving cars will take over 75% of the vehicles currently on the road. Waymo, a Google subsidiary, has already piloted its autonomous cars over 10 million miles, in difficult conditions. Traditional automakers have always been shy about developing a complete electric car. Thus, start-ups like Tesla Motors (TSLA) set out to innovate in the automotive industry for a better future.

Contribution of AI to the automotive industry

AI has also had a visible impact on the automotive industry.

- Manufacturing: Manufacturing involves design and continues throughout the supply chain, from production to post-production. Manufacturers also use AI-based systems for volume and demand forecasting and automated supply chain management decisions. AI helps design both self-driving cars and the equipment and robots, which are used to build these driverless. For example, portable AI-powered exoskeletons are worn by designers to develop better safety and comfort in cars.

- Transport: With the arrival of AI in the automotive industry, transportation has become safer than ever. AI has successfully developed driver assistance, autonomous driving, risk assessment and driver monitoring programs. These innovative installations will remain pre-installed in these incredible self-driving cars.

What if self-driving cars hit the roads in 2022?

Seeing self-driving cars driving on busy city roads is like a dream come true for every human living on this planet. Every human being will prefer to drive in self-driving cars because:

- Experience few or no accidents: Self-driving cars are one of the safest modes of transportation. The chances of facing an accident are very low, even when it comes to driving while intoxicated. This is one of the best options for crash-prone countries like the United States of America where the crash rate is the highest.

- A big no to owning a car: As self-driving cars gradually took over the auto industry, the need to own a car began to wane. Driverless cars will function as shared vehicles. Thus, there will be less traffic problems and more parking spaces.

- Autonomous cars to deliver parcels: Self-driving cars are also designed to deliver packages and food in the near future. Startups like Nuro, Gatik and TuSimple have started making deliveries for customers like Walmart and UPS and plan to launch driverless semi-trucks of passenger vehicles.

- Traffic tickets without fuss: Autonomous cars are also designed to avoid tickets. Millions of tickets worth US $ 150 are issued each year. Thus, these self-driving cars can significantly hamper the income of cities and states.

Share this article

Share

About the Author

More info about the author

[ad_2]

Tom Krumland, second from left, owner and founder of Krumland Auto Group, speaks about his company’s demands for zoning changes Tuesday evening at a meeting of the city’s Planning and Zoning Commission. The company is preparing to build new Ford and Hyundai dealerships and further develop its Nissan dealership. Neighborhood residents, including Charles Currier, center, […]]]>

Tom Krumland, second from left, owner and founder of Krumland Auto Group, speaks about his company’s demands for zoning changes Tuesday evening at a meeting of the city’s Planning and Zoning Commission. The company is preparing to build new Ford and Hyundai dealerships and further develop its Nissan dealership. Neighborhood residents, including Charles Currier, center, […]]]>

Copyright © 2021 Roswell Daily Record

With an agreement in principle between Krumland Auto Group and neighboring residents, the Roswell Planning and Zoning Commission gave unanimous approval on Tuesday to the preliminary dishes and a request for a zoning change by the car dealership so it could proceed. planned construction projects estimated at $ 25 million.

However, the committee voted unanimously to defer the vote on two more requests for zoning changes by the company until next month, when it expects to review the final dishes. The delay could affect the amount of funding the company is able to receive, said KAG owner and founder Tom Krumland.

KAG applied for approval on a preliminary platform to consolidate lots and adjust lot lines and change R-2 residential neighborhoods to C-2 community commercial neighborhoods in the 1900 and 2000 blocks of West Second Street. KAG plans to develop and finance a new Ford dealership in Block 1900, which is the current location of its Hyundai dealership. A second zone change from residential to commercial is also requested for a construction project for the current Nissan dealership at 2111 W. Second St.

Another preliminary flat and zoning change request for the 2300 block of West Second would allow the development and financing of a new Hyundai dealership.

Several residents across an alleyway north of the dealerships filed written protests with the city and spoke at Tuesday’s meeting. Neither of those who spoke said they were against development itself.

Support local journalism

Subscribe to the Roswell Daily Record today.

“We are in favor of economic development,” said Charles Currier. “I have no problem with people making money. I want them to make a lot of money.

“Regarding this proposal, it affects us directly. What we’re talking about is a change in ownership, ”he said.

Community Development Director Kevin Maevers said correspondence received by the town of Currier and other residents was more about potential issues in the future if the property were to be sold and come under a different use.

Some of the lots are zoned residential with special use permits for parking lots that were meant to act as a buffer between commercial areas and residential areas to the north, Maevers said.

“We took the commercial use of the land and wedged it into a residential zoned property with the help of a special use permit, thus nullifying the R-2 development requirements,” he said. .

When this was done in 2003, it was considered good zoning, but Maevers said he thought the special use permit was a mistake.

What the city did around this time is what is now called a transition zone, Maevers said. Transition zones allow the change from one type of land use to another, but still offer development opportunities. What is needed instead is a buffer zone or physical barriers between different types of land use, he said.

“A buffer zone is made up of physical elements that are on the ground. It’s not an area, ”he said.

These components include fencing, berms, and landscaping that can help block sound and create an aesthetically appealing appearance, as well as building setback requirements.

“We need to provide mitigation measures that will create the buffer zone that will mitigate any negative impact,” he said.

Maevers said he sketched out a proposal and discussed it with Krumland and Currier on Tuesday. The proposal contains five requirements for the developer to create this stamp. If the requirements are not met, the city will not issue a certificate of occupancy for the new construction, Maevers said.

According to the proposal, the developer will extend an existing 8 foot perimeter wall around the properties in the areas to be rezoned, plant trees to the rear of the property and provide additional flood protection with retention areas. water.

The final part of the proposal is to include limited development rights in a 125-foot-wide strip of land to allow further separation of commercial property from residential property. No major structures would be permitted in this band, although ancillary structures may be constructed. If the existing Nissan dealership is ever expanded, it will need to have a similar strip of land.

The requirement for limited development rights would also pass with any sale of the property, Maevers said.

Currier said he and his wife were “preliminarily” withdrawing their protest based on the proposal.

“If the final dish continues with all of these things, then I would say our preliminary withdrawal of our protest is a permanent withdrawal of our protest,” he said.

However, one of his neighbors, Hessel Yntema, questioned the commission’s authority to approve zoning requests from current Ford and Nissan dealers, as at least 20% of owners protested. Under state law, that 20% rule means the city council must make the decision, Yntema said.

Yntema said he practiced land use law in Albuquerque and now teaches constitutional law at the Federal Law Enforcement Training Center in Artesia.

He was also concerned about the deal offered by Maevers.

“Something so complicated shouldn’t have been written overnight. I think it would behoove us all to approve the preliminary platform and then come up with a more established agreement on mitigation measures, where we could then formally withdraw our protests next month, ”he said. -he declares.

This would ensure that the commission has the power to approve zoning requests because with the protests withdrawing, the 20% rule would not apply, he said. He urged the committee not to vote on zoning requests for current Ford and Nissan dealerships until January.

The committee voted 7-0 to postpone consideration of these two zoning changes until January. The third zoning change request for the Hyundai dealership has been approved. Krumland said after the meeting that he was a little disappointed but the project will continue.

“We already have people from Ford and Hyundai coming in for an assessment. Making this zoning change affects the appraisal price of what we’re going to do with that land. Without it, we won’t get the amount of funding we need, ”he said.

Krumland said he appreciates the process his company has gone through with the city and residential neighbors.

“Everyone was very courteous tonight and spoke and made their points. I appreciate that. We want to be good neighbors. We have always wanted to be good neighbors, ”he said.

Construction is expected to take two years, he said.

Maevers and Mike Espiritu, president of Roswell-Chaves County Economic Development Corp., highlighted the economic benefits to the community of the KAG project.

The auto industry is expected to return to pre-COVID revenue levels by 2022, said Maevers, which at Roswell was $ 251 million.

The construction is expected to cost $ 25 million and bring in $ 1.8 million in gross revenue taxes, he said.

Maevers said the auto industry as a whole is of net economic benefit to Roswell. Almost 50% of auto sales at Roswell dealerships are sold to people who live out of town, he said. He said other industries were seeing a “hemorrhage” of income as Roswell residents spend money outside the city.

Espiritu said that in addition to the construction work the project will bring, when completed, KAG is expected to hire an additional 100 employees, adding $ 4 million to its annual payroll.

City / RISD reporter Juno Ogle can be reached at 575-622-7710, ext. 205, or [email protected].